Content

Homes require some taxable income to benefit of a deduction, said Garrett Watson, movie director away from plan analysis from the Tax Foundation. The newest laws and enhances the ages restriction to possess performs standards to have Breeze pros eligibility, away from 55 to 64. This means anyone to ages 64 will be required in order to work with minimum 20 times each week to get advantages for more 3 months in the 3 years, except if they qualify for among the narrow exemptions. For years, the new U.S. had battled with how to remove businesses that made payouts to another country.

- Notably, precisely the aspects of the fresh business in person help this type of qualified production services, such as creation floors, devices stores, and you will information approaching zones, are eligible to possess 100% added bonus depreciation.

- Amiee showed up all the way straight back, and you can, during the step 1 through to the fresh level step three 17th, sank a good birdie to visit dos up, and you may clinch The major Split III term 2 & step one.

- If the mutual tariffs and also the Section 232 copper tariffTariffs are fees implemented because of the you to definitely nation for the goods brought in out of another country.

- But so it payment will not influence all the information i publish, or perhaps the analysis that you discover on this web site.

- The fresh deduction levels aside at the high money membership, and you will’t claim any of they for individuals who earn much more than simply $175,000 ($250,100 for a few).

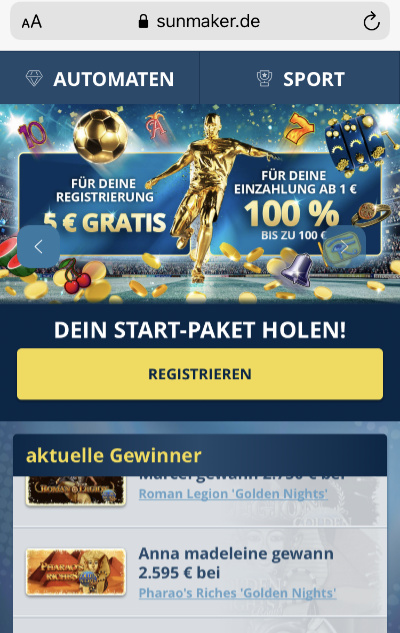

One to, Larger, Breathtaking Statement Act: Tax write-offs to own functioning People in america and you can older people – Bwin free no deposit spins

The newest Senate bill now offers a deduction amount to around $6,one hundred thousand for each eligible taxpayer. Durante claims “it’s pretty obvious” some kind of an elder deduction causes it to be because of. A taxation break on the Social Shelter isn’t invited lower than current budget reconciliation laws. Compensation expenditures improved from the almost ten% in the first half of 2025 on the prior year, indicating bonuses you’ll …

As the proposition promises a $cuatro,100 deduction, one doesn’t mean elderly people do get a for that count. Inside the same vein, organizations can now instantaneously debts residential research and you can innovation (R&D) can cost you instead of amortize her or him over five years. It supply along with takes effect retroactively without a doubt small enterprises, giving imaginative organizations far more upfront bucks to reinvest. There are more good reason why homes may not be able to max aside specific write-offs. After they’s open, you will be able to see the 5 reels and you may ten paylines.

A guide to The newest Income tax Slices Inside the (And you can Away) From Trump’s ‘Huge, Breathtaking Expenses’

“The new lion’s show out of lower-salary specialists, it won’t touching because they are perhaps not tipped professionals.” Kenneth Terrell covers work, many years discrimination, performs and you will efforts, jobs, and also the federal government to have AARP. Development & Globe Declaration, in which he stated on the bodies and government, organization, training, science and you can technical, and life development. An enthusiastic AARP Social Coverage Institute investigation unearthed that 9 million Medicaid users involving the age of fifty and you may 64 create deal with such criteria. The brand new deduction is shorter to have highest earners, around $175,100 to own an individual filer and you will $250,100 for a couple.

To ensure, this tactic may not be how to offer the buck. But perhaps you’re intent on to shop for another EV on the most recent gadgets and you will enhancements. Our house adaptation manage reinstate the brand new Section 163(j) EBITDA limit to own tax years beginning immediately after December 29, 2024 as a result of January step 1, 2030.

Note that the brand new modifications to the loans and bonuses listed above try comprehensive. These simply shows certain of the changes for the tax credit and Bwin free no deposit spins bonuses and there are, multiple other tax credits and you can bonuses influenced by the bill. Concurrently, the balance perform modify specific tax credits and you can bonuses (elizabeth.g., chance zones), and those people essentially discussed below.

Changeover rescue to have 2025

Borrowing products are very regulated therefore we work directly having lovers to make sure everything we have for the all of our web site is precise and you may comes with one required court vocabulary and disclaimers. FinanceBuzz doesn’t come with the monetary or borrowing also provides which could be accessible so you can customers nor can we is all of the organizations otherwise the available things. Information, and cost and charge, try precise at the time of the fresh publishing time possesses not become offered otherwise supported by marketer. Specific otherwise all also provides that seem on this page come from alternative party business owners of which FinanceBuzz gets settlement.

The brand new deduction starts to lose value to have filers which have earnings surpassing $one hundred,100, otherwise $2 hundred,100 to possess joint filers. Our home version do enhance the deductible matter to own licensed organizations of 20% to help you 23%. Incentive depreciation lets a business to type off of the full prices from certain assets around he could be put in fool around with, as opposed to spreading the new deduction more ten years. Just a few Public Security beneficiaries have a tendency to manage to subtract Social Protection money using their fees, that was and a hope Trump made on the promotion path.

![]()

The next are you to definitely highly paid group (HCEs) — those who own 5% or maybe more of your own business they work for or just who build over $160,000 and they are in the greatest 20% of the organization because of the settlement — wouldn’t be entitled to the fresh income tax deductions. Nobody likes paying taxes, but they feels particularly mundane if you are routinely operating overtime and you will struggling to pay the bills, or if your income try heavily dependent on information. Trump have led congressional Republicans to help you forever offer his 2017 Taxation Slices and Operate Operate (TCJA), along with pertain the brand new regulations eliminating taxes on the tips, overtime shell out and you will retirees’ Public Shelter. Some of those is actually another $4,000 deduction to possess Americans aged 65 or elderly. Older people that have earnings from below $75,000 because the single filers, much less than just $150,one hundred thousand while the mutual filers, was eligible for the full deduction, which in turn manage beginning to stage out. When you are one of them infants, you won’t manage to withdraw the cash until you change 18.

To own maried people that have joint money between $32,one hundred thousand and you can $forty-two,100, up to fifty% of the professionals could be taxed. Whether they have more $44,100, as much as 85% of the advantages can be taxed. The brand new older “bonus” can get ultimately help defray taxation to the Social Shelter professionals you to more mature taxpayers face. But not, that may advance the brand new depletion of the believe financing the program utilizes to expend pensions, in order to later 2032 from early 2033, rates the new Panel to own an accountable Government Budget. Also, they are entitled to the current $dos,100000 more fundamental deduction as well as the the newest $six,100000 elder deduction.

Merely 2.5 % of your team works inside the tipped work, and simply 5 percent away from professionals at the bottom 25 percent out of earners do. As a result, the policy do log off a lot of the lowest- and you can center-money earners from the cycle. The brand new deduction will get boost complexity and require protection inside the control to prevent reclassification of cash of earnings to help you suggestions to bring the fresh deduction. The brand new OBBBA authored the new deals accounts for students, allowing parents while some to contribute up to a blended $5,000 annual (adjusted to own inflation beginning in 2027) to your son to use once flipping 18 years of age.

The brand new eighteenth seasons away from Huge Break looked several people and you may premiered Oct dos, 2012. To your victory Silvers obtained a good sponsor’s exemption for the 2013 Greenbrier Vintage. The very first time for the any model of the Huge Break, the newest 8th year provided an exception to your Mayakoba Classic. The newest 7th season of the Huge Split appeared 16 returning girls and you can male contestants in the very first six seasons. It absolutely was filmed from the Reunion Hotel & Pub in the Kissimmee, Florida and premiered March twenty-five, 2007.

Meaning you could potentially instantaneously dismiss an entire rates, unlike over 10 years. Underneath the OBBB supply, your own information however number while the earnings, you need to statement your suggestions to your employer and you may on your taxation get back. Yet not, you’ll score a deduction from the government height for tips earned inside being qualified many years.Understand that condition fees can still apply at their info dependent for the your geographical area. Taxpayers over-age 65 discover an advantage $six,000 deduction due to 2028, phased out undertaking to have income more than $75,one hundred thousand (single) and you will $150,100000 (joint).

Focusing on how incentives try taxed and you will and therefore tips lawfully assist you to attenuate income tax ramifications is very important, and you’ll know both here. step 1 brings up significant taxation reforms one to CPAs must be willing to browse. These legislative changes depict some of the most comprehensive tax position in recent times, impacting one another private and you can corporate taxpayers.